Need to figure out your monthly contributions or the total interest you'll pay on a loan? A financial tool can assist you with that! These convenient online tools allow you to input key factors, such as the principal, interest rate, and loan term. In just a few taps, you'll have a clear breakdown of your loan expenses.

- Utilize a loan calculator to make informed choices about borrowing.

- Compare different loan options based on interest rates and terms.

- Estimate your monthly obligations to ensure you can meet them.

Amortize It : Your Personal Loan Amortization Tool

Struggling to grasp your loan payments? Introducing LoanCal, a powerful online tool designed exactly to help you calculate your monthly mortgage or loan payments. With LoanCal, you can quickly input your loan details, such as the principal amount, interest rate, and time frame, and the tool will a clear amortization schedule showing your monthly payment amounts, interest accrued, and principal paid down over the life of the debt.

- Benefit 1

- Key Feature 2

- Key Feature 3

Determine Loan Payments with Ease

Taking loan amortization schedule calculator free out a loan can be a significant financial commitment. Understanding your monthly payments is crucial to making sound financial plans. Luckily, calculating loan payments doesn't have to be difficult. With a few simple tools and actions, you can swiftly figure out exactly what your monthly expenses will be.

- Use an online loan calculator: There are many free loan calculators available digitally. Simply enter the loan amount, interest rate, and loan term, and the calculator will display your monthly payment.

- Review your loan agreement: Your loan agreement will detail your monthly payment amount.

By taking the time to calculate your loan payments upfront, you can stay clear of any surprises down the road. Remember, knowledge is power when it comes to managing your finances.

Unveil Your Loan Payments With Our Powerful Loan Calculator

Planning a major purchase or need to update your existing debt? Our free Loan Calculator provides the insights you need to understand your monthly payments and overall loan cost. Simply specify your principal, interest rate, and length, and our calculator will show a comprehensive amortization schedule, revealing the breakdown of your principal payments and interest charges over time.

Whether you're researching a mortgage, debt consolidation, or any other type of financing, our Loan Calculator is an invaluable resource to securing informed financial decisions.

Mortgage Calculator - Determine Your Monthly Payment

Figuring out your monthly instalment can be a daunting task. Our simple Loan Calculator makes it a breeze! Simply enter the loan sum, annual percentage, and duration to see your calculated amount. This tool provides clear and concise results, empowering you to make informed financial decisions.

- Simplify your loan calculations.

- Assess your monthly expense.

- Contrast different loan options and terms.

Get started today and take control of your finances!

Know Your Numbers

Securing a loan is often a complex process, full of jargon and daunting numbers. But with a little preparation and knowledge, you are able to navigate the world of loans confidently. Before you apply your loan journey, it's essential to take some time to understand the numbers involved.

- First examining your budget and determining how much you can afford

- Next, research different loan products and compare their interest rates, terms, and fees.

- Remember to, always peruse the fine print before you sign any agreements.

By putting in the effort to understand your numbers, you will be able to secure a loan that meets your needs and helps you achieve your financial goals.

Bradley Pierce Then & Now!

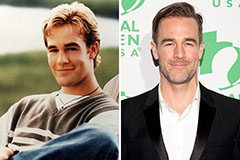

Bradley Pierce Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Robbie Rist Then & Now!

Robbie Rist Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Terry Farrell Then & Now!

Terry Farrell Then & Now!